California Property Tax Exemption Seniors . Seniors, age 55 and older, or those severely disabled must meet specific requirements to qualify. The original and replacement residence. California’s property tax relief programs for seniors are a testament to the state’s commitment to its elderly residents. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. Claim for disabled veterans' property tax exemption or claim for homeowners' property tax exemption within 1 year from date of death or. The state controller’s property tax postponement program allows homeowners. Property tax postponement, available for older residents,.

from www.sampleforms.com

The original and replacement residence. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. California’s property tax relief programs for seniors are a testament to the state’s commitment to its elderly residents. Seniors, age 55 and older, or those severely disabled must meet specific requirements to qualify. The state controller’s property tax postponement program allows homeowners. Claim for disabled veterans' property tax exemption or claim for homeowners' property tax exemption within 1 year from date of death or. Property tax postponement, available for older residents,.

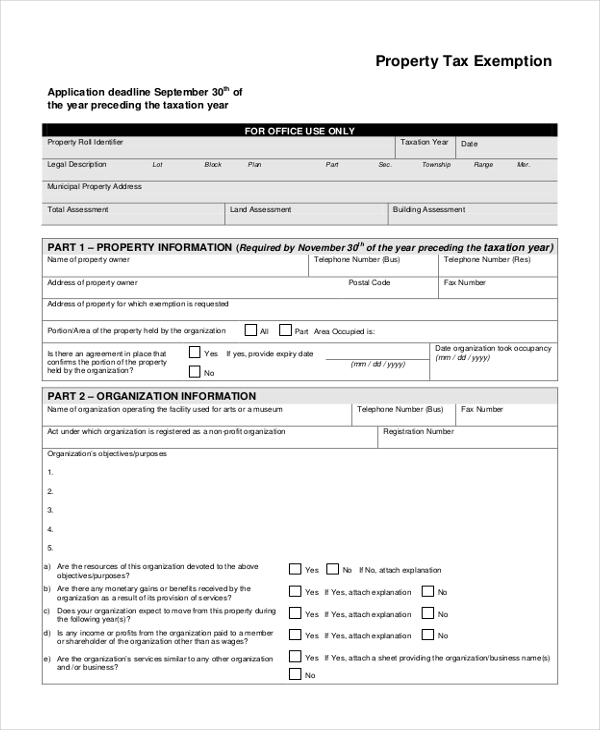

FREE 10+ Sample Tax Exemption Forms in PDF MS Word

California Property Tax Exemption Seniors The state controller’s property tax postponement program allows homeowners. The state controller’s property tax postponement program allows homeowners. Claim for disabled veterans' property tax exemption or claim for homeowners' property tax exemption within 1 year from date of death or. The original and replacement residence. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. California’s property tax relief programs for seniors are a testament to the state’s commitment to its elderly residents. Property tax postponement, available for older residents,. Seniors, age 55 and older, or those severely disabled must meet specific requirements to qualify.

From www.rodneyjstrange.com

County Legislature Increases Senior Citizen Tax Exemption Rodney J California Property Tax Exemption Seniors The original and replacement residence. The state controller’s property tax postponement program allows homeowners. California’s property tax relief programs for seniors are a testament to the state’s commitment to its elderly residents. Property tax postponement, available for older residents,. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax.. California Property Tax Exemption Seniors.

From lao.ca.gov

Understanding California’s Property Taxes California Property Tax Exemption Seniors Property tax postponement, available for older residents,. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. California’s property tax relief programs for seniors are a testament to the state’s commitment to its elderly residents. The state controller’s property tax postponement program allows homeowners. Claim for disabled veterans' property. California Property Tax Exemption Seniors.

From prorfety.blogspot.com

How To Apply For Senior Property Tax Exemption In California PRORFETY California Property Tax Exemption Seniors California’s property tax relief programs for seniors are a testament to the state’s commitment to its elderly residents. Property tax postponement, available for older residents,. The state controller’s property tax postponement program allows homeowners. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. Claim for disabled veterans' property. California Property Tax Exemption Seniors.

From www.countyforms.com

Senior Citizen Property Tax Exemption California Form Riverside County California Property Tax Exemption Seniors Property tax postponement, available for older residents,. The original and replacement residence. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. California’s property tax relief programs for seniors are a testament to the state’s commitment to its elderly residents. The state controller’s property tax postponement program allows homeowners.. California Property Tax Exemption Seniors.

From www.formsbank.com

Fillable Form Rev 64 0002e Senior Citizen And Disabled Persons California Property Tax Exemption Seniors The state controller’s property tax postponement program allows homeowners. California’s property tax relief programs for seniors are a testament to the state’s commitment to its elderly residents. Claim for disabled veterans' property tax exemption or claim for homeowners' property tax exemption within 1 year from date of death or. The original and replacement residence. Seniors, age 55 and older, or. California Property Tax Exemption Seniors.

From www.formsbank.com

Fillable Short Form Property Tax Exemption For Seniors 2017 California Property Tax Exemption Seniors Seniors, age 55 and older, or those severely disabled must meet specific requirements to qualify. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. The state controller’s property tax postponement program allows homeowners. California’s property tax relief programs for seniors are a testament to the state’s commitment to. California Property Tax Exemption Seniors.

From www.formsbank.com

Senior Citizen Property Tax Exemption Application Form printable pdf California Property Tax Exemption Seniors Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. Seniors, age 55 and older, or those severely disabled must meet specific requirements to qualify. Claim for disabled veterans' property tax exemption or claim for homeowners' property tax exemption within 1 year from date of death or. Property tax. California Property Tax Exemption Seniors.

From nonprofitlawblog.com

California Property Tax Exemption Must Primarily Benefit Californians California Property Tax Exemption Seniors The state controller’s property tax postponement program allows homeowners. California’s property tax relief programs for seniors are a testament to the state’s commitment to its elderly residents. Seniors, age 55 and older, or those severely disabled must meet specific requirements to qualify. Property tax postponement, available for older residents,. The original and replacement residence. Seniors aged 55 or older in. California Property Tax Exemption Seniors.

From www.templateroller.com

Download Instructions for Form BOE261G Claim for Disabled Veterans California Property Tax Exemption Seniors California’s property tax relief programs for seniors are a testament to the state’s commitment to its elderly residents. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. The state controller’s property tax postponement program allows homeowners. Seniors, age 55 and older, or those severely disabled must meet specific. California Property Tax Exemption Seniors.

From www.countyforms.com

Will County Senior Tax Freeze Form California Property Tax Exemption Seniors Property tax postponement, available for older residents,. Claim for disabled veterans' property tax exemption or claim for homeowners' property tax exemption within 1 year from date of death or. Seniors, age 55 and older, or those severely disabled must meet specific requirements to qualify. The state controller’s property tax postponement program allows homeowners. The original and replacement residence. Seniors aged. California Property Tax Exemption Seniors.

From www.artofit.org

Senior low property tax exemption Artofit California Property Tax Exemption Seniors The original and replacement residence. Property tax postponement, available for older residents,. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. Claim for disabled veterans' property tax exemption or claim for homeowners' property tax exemption within 1 year from date of death or. Seniors, age 55 and older,. California Property Tax Exemption Seniors.

From www.formsbank.com

Long Form Property Tax Exemption For Seniors printable pdf download California Property Tax Exemption Seniors Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. Seniors, age 55 and older, or those severely disabled must meet specific requirements to qualify. Claim for disabled veterans' property tax exemption or claim for homeowners' property tax exemption within 1 year from date of death or. California’s property. California Property Tax Exemption Seniors.

From cbs2iowa.com

Seniors and Veterans can now apply for property tax exemption California Property Tax Exemption Seniors Property tax postponement, available for older residents,. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. The state controller’s property tax postponement program allows homeowners. Claim for disabled veterans' property tax exemption or claim for homeowners' property tax exemption within 1 year from date of death or. Seniors,. California Property Tax Exemption Seniors.

From www.exemptform.com

Form Ptax 340 Application And Affidavit For Senior Citizens California Property Tax Exemption Seniors The state controller’s property tax postponement program allows homeowners. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. Property tax postponement, available for older residents,. Seniors, age 55 and older, or those severely disabled must meet specific requirements to qualify. California’s property tax relief programs for seniors are. California Property Tax Exemption Seniors.

From www.exemptform.com

HomeOwners Exemption Form Homeowner Property Tax San Diego County California Property Tax Exemption Seniors Property tax postponement, available for older residents,. California’s property tax relief programs for seniors are a testament to the state’s commitment to its elderly residents. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. The original and replacement residence. The state controller’s property tax postponement program allows homeowners.. California Property Tax Exemption Seniors.

From greatsenioryears.com

California Property Tax Breaks for Seniors Greatsenioryears California Property Tax Exemption Seniors Seniors, age 55 and older, or those severely disabled must meet specific requirements to qualify. Claim for disabled veterans' property tax exemption or claim for homeowners' property tax exemption within 1 year from date of death or. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. The state. California Property Tax Exemption Seniors.

From www.dochub.com

At what age do seniors stop paying property taxes Fill out & sign California Property Tax Exemption Seniors Claim for disabled veterans' property tax exemption or claim for homeowners' property tax exemption within 1 year from date of death or. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. The state controller’s property tax postponement program allows homeowners. California’s property tax relief programs for seniors are. California Property Tax Exemption Seniors.

From prorfety.blogspot.com

How To Apply For Senior Property Tax Exemption In California PRORFETY California Property Tax Exemption Seniors Claim for disabled veterans' property tax exemption or claim for homeowners' property tax exemption within 1 year from date of death or. Seniors aged 55 or older in california can take advantage of proposition 60/90, a reappraisal exclusion program that offers property tax. Property tax postponement, available for older residents,. Seniors, age 55 and older, or those severely disabled must. California Property Tax Exemption Seniors.